If you’re an entrepreneur looking to put your small business on the map, Trenton’s Urban Enterprise Zone program is a fantastic way to attract customers and take advantage of all the perks of doing business in the Capital City.

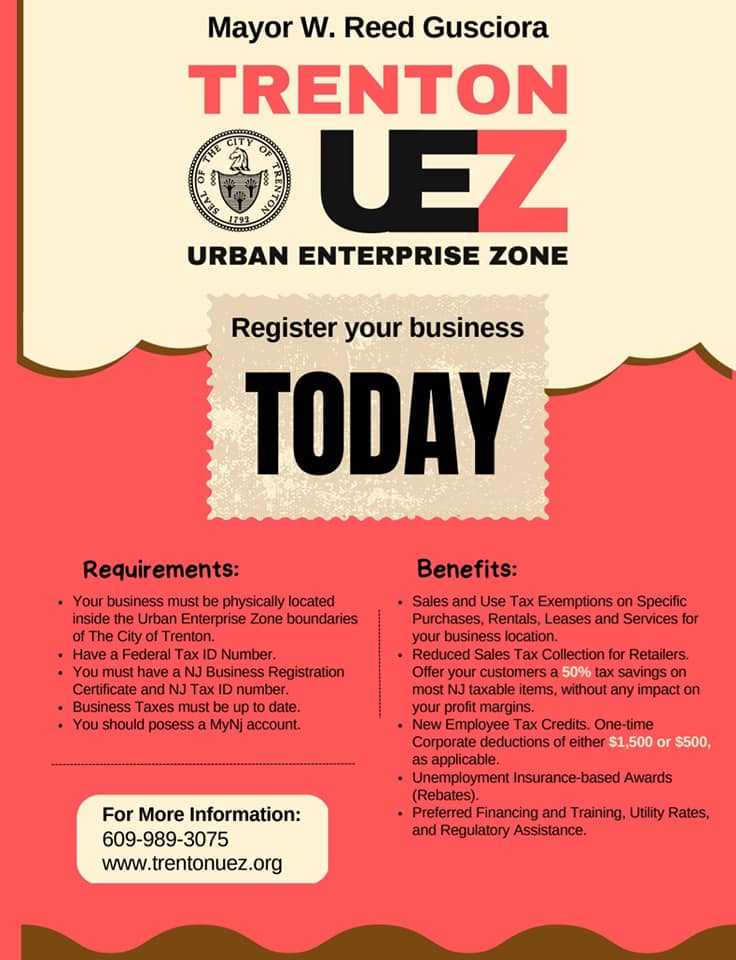

The City of Trenton recently announced registration for the city’s UEZ program. Per the NJ Department of Community Affairs, Urban Enterprise Zones were established “to foster an economic climate that revitalizes designated urban communities and stimulates their growth by encouraging businesses to develop and create private sector jobs through public and private investment.” Throughout the state, over 6,700 businesses have already reaped the benefits of a UEZ designation. As a UEZ-registered location, business owners can access a wide variety of benefits, including:

- Pay no sales tax on building materials, services, and most tangible personal property including equipment for your business

- Charge 3.3125% of sales tax on in-store purchases of goods – one-half the normal rate – making your business a magnet for shoppers

- Obtain a 50% reduction in unemployment insurance taxes and a one-time corporate tax credit of up to $1,500 for each new permanent full time employee hired

- Receive a tax credit against the corporate business tax of 8 % for investment inside the zone

The Urban Enterprise Zone program was originally approved in 1983 in order to incentivize business and new economic activity, as well as lower unemployment, within the designated zones. Over 800 businesses in the City of Trenton have since utilized this program, and with it has come millions of dollars of investments and improvements to the city’s landscape.

This program can be a life-changing opportunity for businesses to draw in new customers and stand out in the community. Per John Ahn, Store Manager of Food Bazaar, “Food Bazaar goes to great lengths to provide the Trenton community with individual attention for its cuisine. The firm makes connections throughout the world in order to provide the residents with the back home flavors they love. The store provides everyday staples and hard to find imported goods familiar to shoppers from others countries. The 3.5% sales tax on goods provides an added incentive for local customers to visit the store.”

In order to qualify, a business must:

- Be located inside the Urban Enterprise Zone boundaries in the City of Trenton

- Have a Federal Tax ID number

- Have an NJ Business Registration certificate as well as a NJ Tax ID

- All business taxes must be up to date

- Applicants must possess a MyNJ account

If you’re ready to take the next steps, applications are available by contacting Eric Maywar via email at emaywar@trentonnj.org. You can read more about the Urban Enterprise Zone program by visiting the DCA website here: About UEZ – NJ DCA. The Capital City is home to a thriving ecosystem of entrepreneurs, now they just need you! Don’t miss the opportunity to take advantage of these game-changing benefits, apply today.