United Way Greater Mercer County (UWGMC) has been teaming up with local organizations for more than ten years to provide free tax filing services to the community. UWGMC’s Volunteer Income Tax Assistance (VITA) program, which reaches low-to-moderate income households and helps them file their taxes, is essential in making sure struggling families can easily access the money they are entitled to endure the uncertainty brought on by the pandemic and other life-changing events.

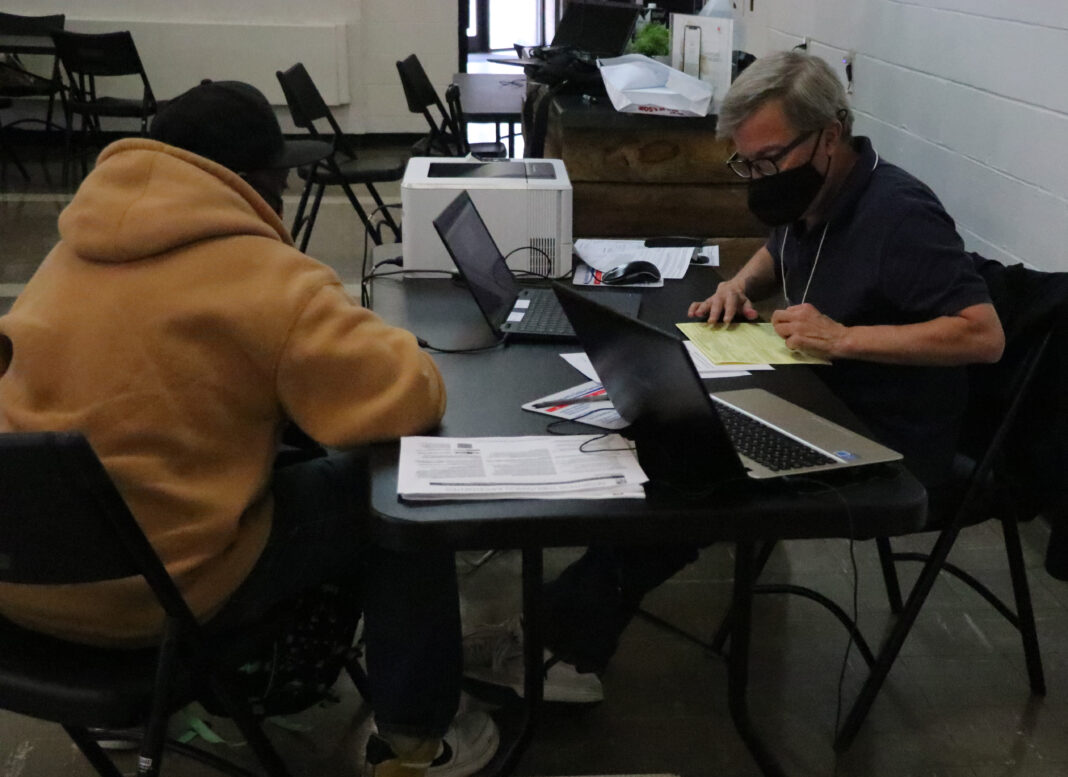

“Most of our folks get a refund,” said Bill Bright, who serves as the Volunteer Income Tax Assistance (VITA) Tax Program Coordinator. “…we double-check all data points, particularly social security numbers and bank info… They signed the file authorization, we file that within 24 hours, and they’re on their way.”

Sandra Toussaint, CEO of UWGMC, explained that this is the better option for residents who make up to $65,000. “Going to a paid preparer, the average cost would be a couple of hundred dollars. And so that’s a couple of hundred dollars for a family that’s already struggling. So those are dollars that they can save, put back into their pockets and utilize that for basic needs,” Toussaint said.

In 2021, UWGMC lost sites to provide this service due to the pandemic. They reached out to the Salvation Army and Lt. Alan Porchetti, Luitenent of the Salvation Army. They came to an agreement where UWGMC rents the space out during tax season for clients in Trenton. “We provide the space, and every time the clients come into us, we always refer them saying, hey, just to let you know…if you want to come in and get your taxes done…you can do it,” Porchetta said.

Like many organizations, there are challenges bought on by the pandemic. Current sites for this tax year include Salvation Army, Boys & Girls Club of Mercer County, Mercer County Connection, and the United Way of Greater Mercer County office. UWGMC is also partnering with the Children’s Home Society in Trenton and other community organizations.

Raja Jones, a Robbinsville resident who was born and raised in Trenton was filing his taxes on Wednesday at the Salvation Army site. He has been coming to United Way for three years to get his taxes done, and he plans on coming back next year as well. “It feels good because it’s kind of hard to get the taxes done,” Jones said. “Some people are not good with the computer, and it’s good to come here to get hands-on service. That way, you can learn if you want to do it on your own, or you can just come in.”

For the 2020 tax year, roughly 1,100 tax returns were prepared, putting over $1.4 million back into the Mercer County local economy. Taxes were prepared virtually and in-person at several sites, including the Salvation Army, Boys & Girls Club of Mercer County, and the United Way of Greater Mercer County office (CDC health & safety guidelines were followed). This saved Mercer County residents more than $440,000.

Kathy Shaw, a volunteer, said they try not to turn anyone away. “We try and help everybody. No matter what the circumstances. Sometimes we can, and sometimes we can’t. But we do our best. And we don’t turn anybody away or try not to,” Shaw said.

To learn more visit: https://www.uwgmc.org/freetaxprogram