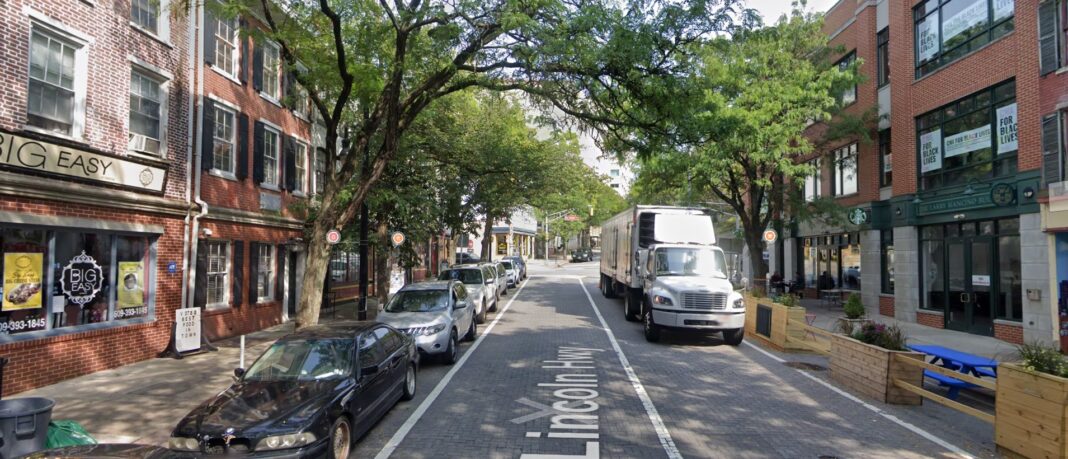

The South Warren Street business district will be getting a $500,000 makeover.

The funding will come from the State’s Urban Enterprise Zone (UEZ) program, not the City taxpayers, and Gusciora was pleased that Council gave its approval last night. The City plans to create streetscape improvements including new sidewalks, new curbing, new skirts, and repairs to the historic brickwork on West Front Street that has been plagued with utility repairs.

“The improvements we are doing to our downtown infrastructure will not only give the street a makeover but will help attract new businesses and customers alike,” said Gusciora. “I’ve heard many complaints from business owners and residents over the years about the condition of sidewalks and the deteriorating brickwork. Funding has always been the issue, so it’s great that Council finally gave our plans the green light.”

Trenton’s downtown is a hub for restaurants and bars that are frequented by state employees and residents after work and throughout the year. Gusciora pledged to make the area inviting for outside visitors who will help generate new jobs and business growth.

“With the amount of foot traffic downtown, we hope these improvements will get a lot of mileage for our business owners in the heart of the Capital City,” said Gusciora. “These improvements will enhance public safety, aesthetics, and convenience for our residents, visitors, and workers. It will also be a focus of additional street fairs for pop-up merchants and entrepreneurs.”

“The South Warren Street Corridor is a key business and entertainment district in Trenton’s downtown,” said George Sowa, CEO of Greater Trenton. “These improvements made with UEZ funds will be a catalyst for business and job growth for Trentonians in this important district and throughout the city.”

City Council also approved a $250,000 budget for the City’s UEZ program to provide more business outreach and planning last night. Gusciora believes that by investing in the City’s business development, it will help retain small businesses and foster new growth.

“We need to bring these revitalization tools to other UEZ areas around the City. The staffing increase and administrative funding will give us the power do just that,” Gusciora said. “The City’s zone covers most of the City, extending into each ward. We’re moving this program into overdrive in the coming months to extend its reach, especially to underserved areas.”

Gusciora noted that new sidewalks are going in the Passaic Street business corridor and UEZ funding will help foster growth and jobs there. The City just installed new sidewalks in front of the historic Candlelight lounge. The City is also working with the State Department of Environmental Protection to fix the ballast fencing across the street along the D&R Canal.

“These are prime resources bringing more bling to the business districts in the Capital City. We want to build back the vibrant business community that existed pre-pandemic, and we want to use this much-needed State funding to do it,” Gusciora said. “We are currently working with the State to improve the UEZ areas designations and reigniting this powerful program.”

Businesses and customers in UEZ-designated areas receive benefits to help stimulate local economic activity. The State provides qualified businesses within UEZs with various tax relief incentives:

- The right to purchase items (except motor vehicles and energy) and most services (except telecommunications and utility services) without paying Sales Tax;

- Corporation Business Tax credits for certain businesses hiring new employees;

- The right for certified sellers to apply a partial Sales Tax exemption to most taxable sales of tangible personal property that occur in the UEZ. The exemption allows businesses to charge half the State Sales Tax rate on exempt sales. The current Sales Tax rate in UEZs is 3.3125%;

- Loans, grants, and assistance is provided to qualified businesses from the distribution of Sales Tax collected (UEZ Assistance Fund);

- Unemployment insurance tax benefits; and

- A Sales and Use Tax exemption for the purchase of natural gas and electricity used by a qualified UEZ manufacturer that meets specific eligibility requirements.